Benefits of Ethos Pay

Simplify your bill payment with Ethos Pay – More time for what matters

With Ethos Pay, you can save time and hassle by not having to remember to make your monthly payments. We offer a flexible budgeting schedule that can be customized to fit your needs.

Our aim is to make bill-paying more convenient for you. With Ethos Pay, you won’t have to worry about forgetting to pay your bills on time. Instead, we’ll automatically debit your bank account based on a schedule that suits you best. This allows you to budget for smaller and more manageable debits, making the whole process easier and stress-free.

With Ethos Pay:

- Automate your payments for hassle-free bill-paying.

- Budget more effectively with smaller, manageable debits.

- Customize your debit schedule to match your payday.

- Never worry about missed payments and potentially improve your credit score.

Pay off your loan faster

Why pay a car payment in 60 months when you could do it in 54? Term reduction is possible with even the lowest interest rate. Let us handle your payments for you. We’ll create a debit schedule that works best for you.

Based on customer experience term reductions:

- A 60-month loan can be reduced by an average of 5 months

- A 75-month loan can be reduced by an average of 6 months

- An 84-month loan can be reduced by an average of 7 months

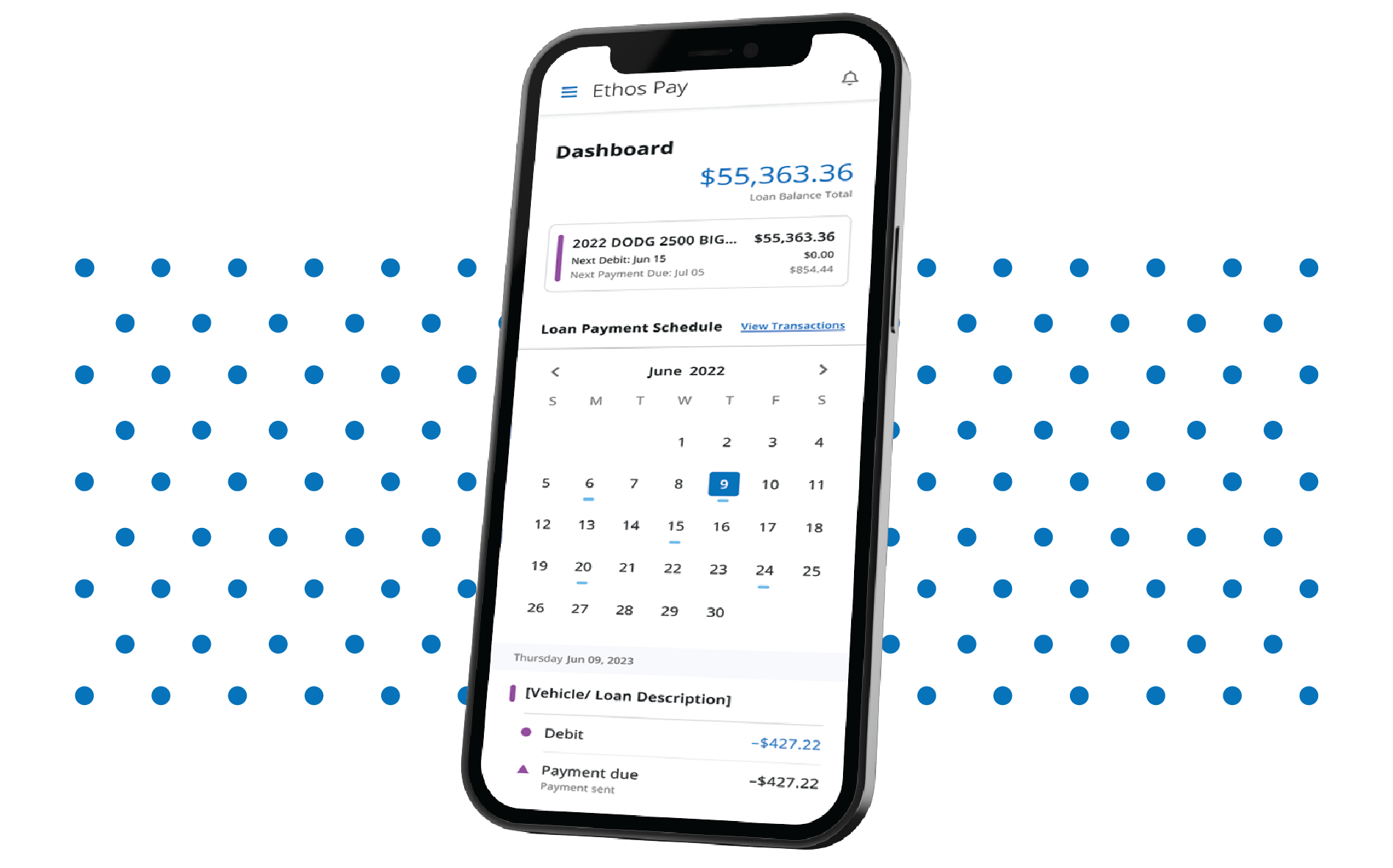

Account Dashboard Features

Personally manage information in your Ethos Pay dashboard, including:

-

- Update your contact information

- Add a loan

- Remove or cancel an existing loan program

- Adjust your next debit date

- Change your debit frequency

- Customize email notifications for upcoming payments

Examples

With Ethos Pay, we create a debit schedule that works best for you so you can build positive equity. This means a lower payoff amount and less money spent on interest payments.

Here is an example of how our program can help you pay off your loan faster. Let’s assume you have a monthly car payment of $600. Under your current payment plan, you will pay $7,200 towards your car loan at the end of one year (12 monthly payments of $600).

If you get paid WEEKLY, we will debit ¼ of your loan amount ($150) for each pay period. At the end of one year, you will have paid $7,800 towards your car loan (52 weekly payments of $150). You are now $600 ahead on paying off the principal of your vehicle.*

If you get paid BIWEEKLY, we will debit ½ of your loan amount ($300) for each pay period. At the end of one year, you will have paid $7,800 towards your car loan (26 payments of $300). You are now $600 ahead on paying off the principal of your vehicle.*

If you get paid SEMI-MONTHLY and decide to pay an additional $50.00 each month, we will debit ½ of the amount ($325) for each pay period. At the end of one year, you will have paid $7,800 towards your car loan (24 payments of $325). You are now $600 ahead on paying of the principal of your vehicle.*

If you get paid MONTHLY and decide to pay an additional $50.00, we will debit $650 each pay period. At the end of one year, you will have paid $7,800 towards your car loan (12 monthly payments of $650). You are now $600 ahead on paying off the principal of your vehicle.*

Ethos Pay will continue to make one-time monthly payments to your lender with the additional funds included. To have the extra money applied to the principal, the customer should reach out to the lender and make a note on their loan; otherwise, the extra funds will be applied to the next month’s payments. Any payment towards the principal does not include service fees. Click here to see our Service Fees.